How much is enough to support you in your retirement income goal?

This depends on your goals and your financial situation when you leave your 9 to 5.

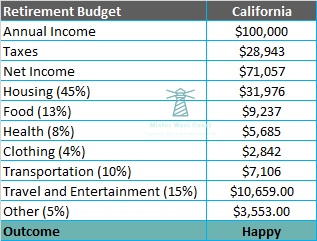

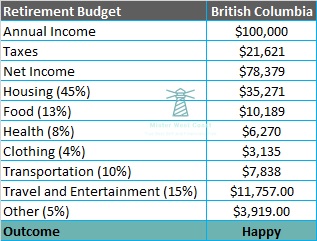

Let us assume that based on the following budget we have determined we want to earn an annual income of $100,000 in retirement.

You currently earn an annual salary of $142,857.15, are 25 years of age and want to exit the 9 to 5 at 54 years of age.

You Will Be 55 When You Reach Your Retirement Income Goal

And, your first year of retirement.

Life expectancy averages 82.96 years of age in Canada and 79.11 in the United States. However, life expectancy averages will not factor into our calculations. A person aligned with their purpose, who maintains healthy lifestyle choices and whom also retires from a stressful 9 to 5 early can extend their life expectancy. Scientific studies argue both sides of this life expectancy/early retirement connection by bringing in a variety of variables. We focus here on financial preparedness regardless of age and life expectancy.

How Much Do You Need to Have Saved?

$2 Million Dollars with a phased annual drawdown and assumed 5% annual return on investment. The phased annual drawdown begins at 6% per year from 55 and 69 years of age. 7% from 70 to 80 years of age. And, 9% from 81 to 91 years of age.

Actually, these assumptions produce an average annual income of $102,462. In fact, at 91 years of age your savings holds a balance of just over $779,000. With which you can throw an amazing party every year with friends!

Even more, you have options. Adjusting your annual drawdown to maintain the $100k annual income requirement or slowly reduce your income and leave the balance to your favorite cause.

With ongoing adjustments to annual drawdown to maintain an average annual income of $100k, your savings will meet your retirement income goal until you reach age 99.

How Much Do You Have To Put Away

To produce $2 Million in savings? Assuming 5% return on investment and your investment growth is tax sheltered in a RRSP, 401K or other tax-sheltered investment vehicle your total cash contribution is $985,224.

This cash contribution can be achieved in the following three scenarios:

Annual Income $142,857.15 with 2% Annual Increases in Income

17% Annual Savings over 29 years ($24,285 year-1) – Meets your goal of retiring at 54 years of age

20% Annual Savings over 27 years ($28,571 year-1)

30% Annual Savings over 22 years ($42,857 year-1)

Or

40% Annual Savings over 18 years ($57,142 year-1)

Yes, that is correct, if you enter the workforce and begin saving 40% of your $142,857 annual income each year beginning at age 25 you can retire in 18 years at age 43. Provided you maximize contributions to tax sheltered retirement savings accounts and have avoided these Great Destroyers of Wealth.

Additionally, all of our posts in the Retirement Series can be found here.

Finally, more great content can be discovered on our Youtube channel.