Due to the higher costs of housing a family now needs to earn a total income in excess of $60,000 to escape poverty. These requirements are higher on the West Coast.

According to this years Fraser Institute report A Critical Assessment of Canadas Official Poverty Line, poverty means not being able to afford the things that most others take for granted. It means not being able to fully participate in the life of the community because of your low income – even if you can afford the basic necessities.

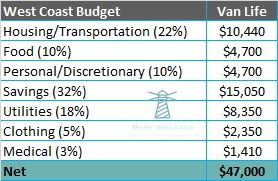

At the $60,000 income level, over $13,000 will be taken by the tax man. Yes, leaving you with less than $47,000 to live on.

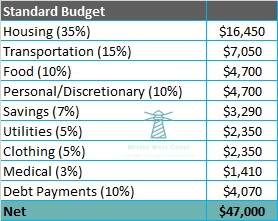

Standard Budget

Using standard budgeting guidelines this would give you a budget as follows:

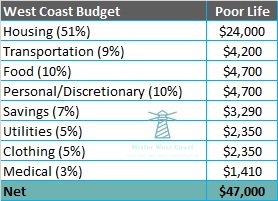

West Coast Budget

Can you live on this budget in California or the Lower Mainland of BC?

Yes, With the following adjustments:

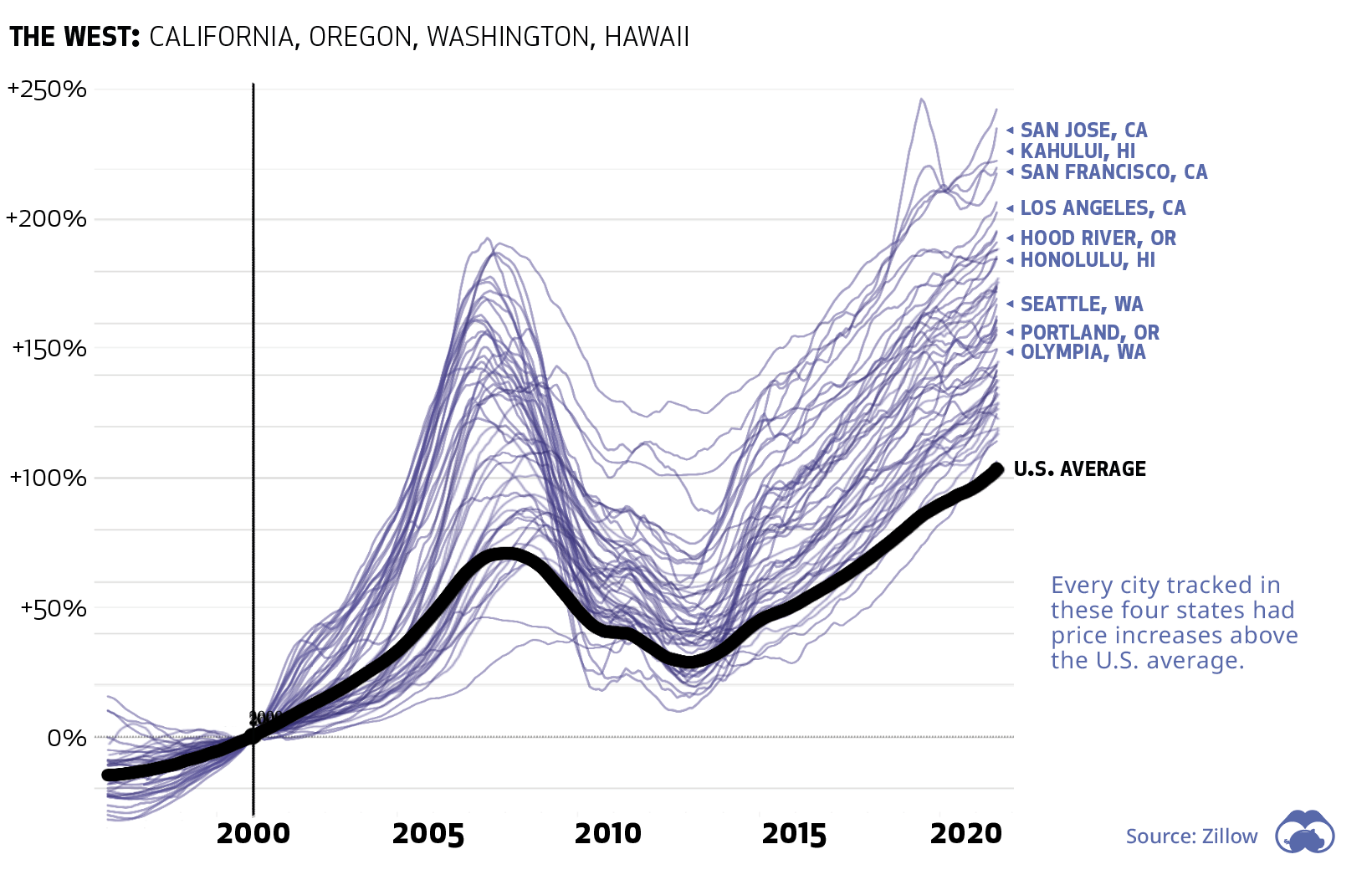

The main driver behind the $60,000 total minimum income is the excessive rise in home prices in major economic centers. Visual Capitalist put this best in the following graph:

Even when renting, earnings have lost purchasing power against rentals in the past 10-years. That is, with average market rent increasing over 75% while median income only increased by 18%.

Could you purchase a home on this budget in these areas?

Not A West Coast House

Of the 21 Lower Mainland municipalizes eight require annual income of over $120,000.

Five require annual income of over $150,000.

Six require annual income of over $200,000

Lastly, two require income over $400,000 to qualify to purchase a home.

One of these municipalities is ferry/boat access only.

To prosper and advance, the American business sector is going to need a financial system oriented toward business, not home ownership.

Edmund Phelps

These household entry level incomes are an interesting trend. Given 50% of Lower Mainland employees earn less than $126,000 per year.

You could qualify to purchase a condo in only 1 of the 21 Lower Mainland municipalities.

To clarify, this would require no debt obligations and requires other reduced expenses in your budget.

Similar Findings In The West Coast of California

This is not a getting ahead budget or lifestyle. It will not help you reach goals of financial independence.

Yet, if your heart is set on living on the West Coast, a goal worth pursing, you need to know that you will pay to live here.

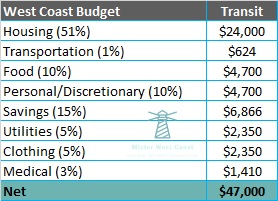

Consider Starting Out Small

For example if you were able to eliminate your automotive expenses and take public transit, or walk to work, you could increase your savings by 8%.

And, if you want to get aggressive with securing your West Coast future, finding a way to combine your housing and transportation costs could be a multiplier.

This could be a tiny home or van life option. For this example I have priced out a relatively high-end van, additional costs for fuel, insurance and overnight fees.

This option would allow you to divert 32% of your $60k income to savings. Thus, giving you a strong boost toward a financially independent future.

I view this as a short-term option that could be used as a springboard to build savings and options for future goals. One of your goals may be entering the housing market.

Combine this option with your job at a good company who provides community garden plots for employees. Now, you could even grow your own seasonal herbs and vegetables without a back yard of your own.

Greener Pastures

As an alternative you could also look for greener pastures in cities where moderate home price increases have occurred over the past 10 years. And, where stable employment is still attainable. Your money is safer in these markets. The money you save monthly can be used for a West Coast vacation or savings for when the bottom drops out of the current inflated housing markets.

Then, Pounce.

Why did you read this entire article without complaining about the loss of $13,000 of your hard-earned dollars being taken by the tax corporation working for your country?

Additionally, all of our posts in the Financial Freedom Series can be found here. Finally, more great content can be discovered on our Youtube channel.